Good Morning ,

RIPPLE’S XRP LAWSUIT ENTERS NEW CHAPTER AS BOTH PARTIES FILE APPEALS

The SEC and Ripple are entering the appeals phase of their XRP lawsuit, with both parties preparing to challenge aspects of the initial ruling in a process that could extend into early 2026

▪️SEC appealing Judge Torres’ ruling in Ripple case

▪️Ripple filed cross-appeal on institutional sales decision

▪️Next step: SEC to file Form C detailing appeal scope

▪️Briefing process could last until July 2025

▪️Final appellate court decision possible in early 2026

The Securities and Exchange Commission (SEC) and Ripple Labs are gearing up for the next phase of their legal battle over XRP, as both parties have filed notices to appeal different aspects of Judge Analisa Torres’ ruling from July 2024.

The case, which has significant implications for the cryptocurrency industry, is now moving to the U.S. Court of Appeals for the Second Circuit.

Stuart Alderoty, Ripple’s Chief Legal Officer, expressed confidence in the company’s position as the case moves forward. “I felt good about our case in the Southern District of New York. I feel even better about our case in the Second Circuit,” Alderoty stated in a recent interview.

He believes the SEC’s appeal will ultimately “backfire” and benefit the crypto industry as a whole.

The appeals process is set to begin with both parties filing Form C documents, which will outline the specific aspects of Judge Torres’ ruling they intend to challenge. The SEC is due to file its Form C on October 16, 2024, with Ripple following suit seven days later. These filings will provide clarity on the focus of each party’s appeal.

Following the Form C submissions, a briefing schedule will be established. The SEC will have 90 days to submit its comprehensive legal argument explaining why it believes Judge Torres erred in her decision. Ripple will then have the opportunity to respond to the SEC’s arguments and file its own opening cross-appeal brief.

Alderoty estimates that the briefing process could extend until July 2025, approximately nine months from now. This timeline suggests that a final decision from the appellate court might not come until early 2026, unless the parties reach an agreement to end the legal dispute sooner.

The case has drawn significant attention due to its potential to set precedent for how securities laws are applied to token issuers, particularly within the Southern District of New York, a major financial hub. Judge Torres’ initial ruling found that XRP is “not necessarily a security on its face,” a decision that has been met with both support and skepticism from other judges in similar cases.

While Ripple celebrated aspects of Judge Torres’ ruling, the company was ordered to pay a $125 million fine over XRP transactions that were found to have violated securities laws. The SEC had initially sought a much larger penalty of $2 billion.

As the case moves to the appellate level, both parties are preparing to argue their positions. The SEC maintains that Judge Torres’ ruling “conflicts with decades of Supreme Court precedent and securities laws.”

Ripple, on the other hand, plans to argue that for a digital asset to be considered an investment contract, a contract with rights and obligations is necessary.

@ Newshounds News™

Source: Blockonomi

~~~~~~~~~

MICA-COMPLIANT STABLECOINS TAKE MARKET SHARE OF EURO-STABLECOIN SECTOR: KAIKO RESEARCH

Since the implementation of select provisions of the EU’s Markets in Crypto-Assets (MiCA) regulations in June, MiCA-compliant stablecoins, such as Circle’s EURC and Société Générale’s EURCV, have dominated the euro-stablecoin market, according to a Kaiko Research report.

Circle’s EURC and Société Générale’s EURCV now hold a record 67% market share of the euro-stablecoin market, the report added.

@ Newshounds News™

Read more: The Block

~~~~~~~~~

ITALY PLANS TO RAISE CAPITAL GAINS TAX ON BITCOIN FROM 26% TO 42%: REPORT

The Italian tax authority plans to raise capital gains tax on bitcoin to 42% as part of 2025 budget plans.

Crypto capital gains in Italy have been taxed above €2,000 at 26% from the 2023 tax year.

@ Newshounds News™

Read More: The Block

~~~~~~~~~

RIPPLE PRESIDENT UNVEILS PLANS TO INTEGRATE XRP AND RLUSD INTO PAYMENT SOLUTIONS

▪️Ripple, the company behind cross-border solutions has gained attention from market observers after an announcement of the RLUSD launch.

▪️Ripple is committed to ensuring transparency for both investors and users by releasing monthly reports from independent third parties that verify the reserves backing RLUSD.

On October 15, Ripple’s president Monica Long announced the entry of Ripple into the rapidly expanding stablecoin market, a launch of its new enterprise-grade stablecoin called “Ripple USD”(RLUSD). On the social media platform X, Ripple also announced the development of RLUSD, prompting reactions from notable Monica Long and other figures in the cryptocurrency community.

The president disclosed this on the first day of the Miami Ripple Swell 2024 conference. Once the New York Department of Financial Services (NYDFS) approves the stablecoin’s launch, RLUSD will be accessible on several platforms, including Bitstamp, a European cryptocurrency exchange founded in 2011, The Independent Reserve, Bitso, MoonPay, CoinMENA, Bullish, and Uphold.

Additionally, the firm partnered with B2C2, a global leader in institutional liquidity for digital assets, and Keyrock as market makers to facilitate the creation of liquidity and adoption across global markets. It is worth noting that the former Center Consortium CEO David Puth and Former FDIC Chair Sheila Bair are appointed to the RLUSD advisory board.

Ripple’s RLUSD: Highlighted Features

One of the key features of RLUSD is its compliance-first approach. Ripple emphasizes regulatory adherence in the design of the stablecoin, with plans to publish monthly attestations of its reserves by an independent accounting firm. This is particularly relevant as Ripple has navigated complex legal challenges, including an ongoing lawsuit with the U.S. Securities and Exchange Commission (SEC).

The introduction of RLUSD is seen as a strategic move to bolster Ripple’s position in the market. The stablecoin aims to provide solutions for cross-border payments, on and off-ramps for cryptocurrency exchanges, DeFi, and real-world asset (RWA) tokenization.

Ripple’s CEO, Brad Garlinghous stated that the stablecoin will first be launched on the XRP Ledger and Ethereum networks, enabling real-time transactions and the conversion between fiat and digital currencies.

RLUSD is designed to connect traditional finance with the digital world, offering a secure way for users to trade in and out of cryptocurrency markets without the stress of price fluctuations. It also aims to encourage quicker adoption of digital currencies by creating an entry point into the blockchain ecosystem.

Ripple’s advisory board members have highlighted the critical need for stability and compliance as the digital economy evolves. Sheila Bair remarked that “stablecoins will play a key role in modernizing financial infrastructure.”

As per our data, Ripple’s trading volume has increased by 7.80% over the last 24 hours with a market cap of $ 30.78 billion. Despite its 0.39% price drop in the last 24 hours, XRP is currently trading at $0.5453.

@ Newshounds News™

Source: Crypto News Flash

~~~~~~~~~

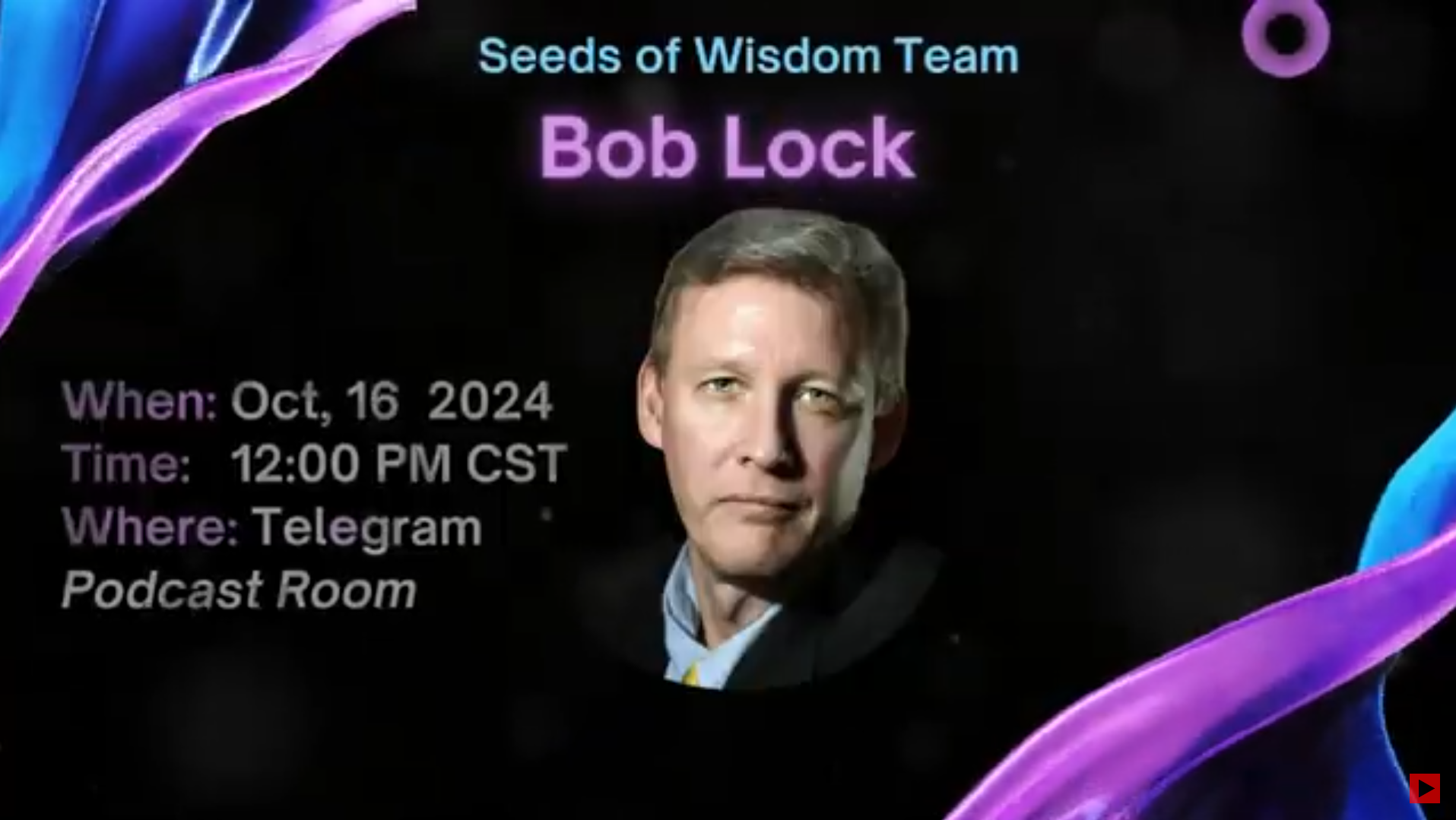

🌍 BOB LOCK CALL WED. NOON CENTRAL – PODCAST CALL TELEGRAM ROOM. | Youtube

LIVE CALL WITH BOB LOCK WEDNESDAY, OCTOBER 16TH AT 1 PM ET, NOON CT

Join Call: https://t.me/+VAm-AlWWqWPzyK8G

Bob Lock Mug: https://t.me/c/1522565332/4802

@ Newshounds News™

Source: Seeds of Wisdom Team RV Currency Facts

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound’s Podcast Link

Newshound’s News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Newsletter