The Central Bank Indicates A Decline In The Rates Of Exported Currency And Inflation In Iraq.

Energy and Business Iraq Central Bank inflation Issuing currency rates

2025-08-21 01:25 Shafaq News – Baghdad The Central Bank of Iraq revealed on Thursday a decline in the country’s currency exports and inflation for the second half of 2025.

The bank said in a report seen by Shafaq News Agency that “the currency issued by the bank recorded a 3.8% decline in the average rate in the second half of 2025, reaching 98.4 trillion dinars, compared to its value of 102.3 trillion dinars in the second quarter of 2024.”

He added, “The decline in the issued currency has contributed to a decline in the inflation rate, which maintains the stability of the general price level.” The bank’s report also indicated that “the inflation rate decreased by 76% in the second half of 2025, reaching 0.8%, compared to the second quarter of 2024, which reached 3.3%.”

He stressed that “the decline in the inflation rate indicates a decline in the general price level and

leads to an improvement in the purchasing power of individuals and institutions.”

Issued currency is defined as: the currency issued by the Central Bank of Iraq into circulation (i.e., printed), excluding the currency in the vaults of the Central Bank.

https://shafaq.com/ar/اقتصـاد/البنك-المركزي-ي-شر-انخفاضا-بمعدلات-العملة-المصدرة-والتضخم-في-العراق

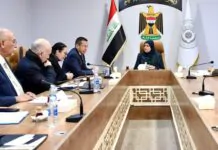

Investment Authority: We Have Developed A Plan To Attract Investments Worth $250 Billion.

Baghdad – INA – Nassar Al-Hajj The National Investment Commission announced on Wednesday that

investment projects have served six vital sectors and reduced reliance on oil. It also indicated a

plan to attract $250 billion in investments over the next two years.

“The government’s supportive investment orientations and legislative and regulatory reforms have succeeded in attracting Arab and foreign investments exceeding $100 billion in various economic sectors over the past two years,” Hanan Jassim, the commission’s spokeswoman, told the Iraqi News Agency (INA). She added,

“Investment in Iraq has had a direct impact on driving sustainable development and diversifying sources of income,” noting that “investments have been directed toward vital sectors such as industry, infrastructure, housing, energy, education, and health, contributing to the creation of new job opportunities and increasing the size of the gross domestic product, which represents an important step toward reducing dependence on oil as the primary source of revenue.”

She continued, “Recent years have witnessed remarkable progress thanks to government measures and programs adopted by the Authority, most notably the activation of the single window, joining international agreements to protect and encourage investment, and developing an integrated investment map that includes more than 100 strategic investment opportunities in diverse sectors.”

She explained that “the investment steps have boosted investor confidence and contributed to positioning Iraq among the region’s promising destinations,” noting that “an ambitious plan has been put in place to attract up to $250 billion over the next two years.”

Regarding Prime Minister Mohammed Shia al-Sudani’s directives to remove obstacles facing the private sector and adapt laws to serve industrial development plans, she explained that

“the National Investment Commission is working to align investment legislation with the directives by

simplifying procedures, reducing red tape, expanding the scope of public-private partnerships, and

providing flexible incentives and solid legal guarantees.”

She pointed out that “these measures will enhance the effectiveness of existing investments and

increase Iraq’s attractiveness as a safe and stable investment environment, serving the goals of comprehensive economic development.” https://ina.iq/ar/economie/241392-250.html

A National Team To Improve Iraq’s Credit Rating: An Economic Bet To Gain Global Confidence And Free The Economy From “Oil Restrictions.”

August 21, 2025 Baghdad / Iraq Observer As Iraq approaches a pivotal stage in its economic trajectory,

Prime Minister Mohammed Shia al-Sudani on Wednesday

directed the formation of a joint national team to improve the country’s sovereign credit rating.

This move has been described as a serious attempt to

reshape Iraq’s financial image in the eyes of the international community,

enhance investment opportunities, and reduce the cost of external borrowing.

This move comes at a time when the Iraqi economy faces major challenges, ranging from a chronic fiscal deficit, near-total dependence on oil revenues, and severe fluctuations in global energy markets.

*Important Features Of Reform

According to a statement issued by the Prime Minister’s media office, the new team will be headed by the Governor of the Central Bank of Iraq, and will include representatives from the Ministries of Finance, Oil, Planning, and the Securities Commission, in addition to the Prime Minister’s Office and a number of economic and banking institutions.

This team will be tasked with developing an integrated strategy to improve Iraq’s credit rating, with

clear and measurable objectives, periodic reports to be submitted to official bodies, and

direct coordination with international credit rating agencies, most notably Fitch, S&P, and Moody’s.

According to the statement, the strategy will include strengthening financial governance,

risk management, and developing the business environment in line with economic reform plans, with a focus on diversifying national income sources and reducing reliance on oil as the sole primary resource.

*Credit Rating: What Does It Mean for Iraq?

A country’s sovereign credit rating reflects the government’s ability to meet its financial obligations and is a pivotal tool in determining borrowing costs and attracting foreign investment.

Iraq, which relies on oil exports for more than 90% of its financial resources, finds itself vulnerable to the risks of energy price volatility, weakening its standing with rating agencies.

Economic expert Ahmed Abdel Rabbo explains to Iraq Observer that the importance of

improving Iraq’s credit rating lies in three main axes:

“The first is reducing the cost of borrowing.

Each notch higher in the rating reduces interest rates on sovereign loans, freeing up huge sums that can be invested in development projects.”

The second is “attracting foreign investment.

Investors tend to direct their funds toward countries with higher ratings,which could open the door to new capital flows into Iraq.”

The third axis, according to Abdul Rabbo, is”enhancing confidence in the national economy.

A good rating reflects the government’s commitment to its debts and

conveys a positive image of the stability of the financial system.” Abdul Rabbo adds that

“forming the national team is a step in the right direction, but he stresses the need for artistic work to be coupled with real political and economic steps, such as rationalizing public spending, combating corruption, and diversifying the economy away from oil.”

*Politics and economics in one balance

Standard & Poor’s affirmed Iraq’s rating at B-/B with a stable outlook last February.

Despite the country’s solid foreign exchange reserves, the agency noted the existence of real risks that could lead to a downgrade, most notably:

“a weak institutional framework and political uncertainty, a lack of economic diversification and overreliance on oil, security and political risks that make the economic situation unpredictable, and the potential for public finances to be impacted by a sharp or prolonged decline in oil prices.”

According to the agency’s report, any deterioration in the government’s ability to manage public debt

or increased budget pressures could lead to negative rating decisions.

*Fiscal deficit and public debt: worrying figures

Iraq suffers from a persistent financial deficit in its annual budgets due to the expansion of operating expenses, particularly salaries for the massive public sector, which consumes the majority of revenues.

In light of these burdens, the public debt is rising,

increasing the risk that the government will be unable to meet its obligations without relying on oil.

Economist Abdul Rabbah points out that “inflexible fiscal policies and unplanned expenditures are among the biggest challenges facing Iraq,” explaining that improving its credit rating will not be possible unless these structural imbalances are addressed.

https://observeriraq.net/فريق-وطني-لتحسين-التصنيف-الائتماني-لل/

For current and reliable Iraqi news please visit: https://www.bondladyscorner.com/