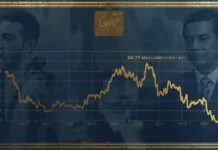

Bitcoin’s computing power reached a new all-time high in October, with the network’s total hashrate briefly crossing 1.13 zettahashes per second (Zh/s) — marking another milestone for the world’s largest cryptocurrency.

However, despite the record, Bitcoin miners faced shrinking profitability, as rising network difficulty, declining Bitcoin prices, and higher energy costs weighed on margins.Hashrate Soars, Profitability Declines

According to data from CoinWarz, Bitcoin’s hashrate — a measure of the total computational power securing the network — surged to a record in October. Analysts at TeraHash noted that the increase was “largely driven by infrastructure expansions in North America, Kazakhstan, and the Middle East,” highlighting continued global investment in Bitcoin mining operations.

While a higher hashrate strengthens the network’s security and decentralization, it also increases mining difficulty — the algorithmic measure that determines how hard it is to find new Bitcoin blocks.

As a result, daily revenue per exahash per second (EH/s) dropped 7% month-over-month, from $52,000 in September to $48,000 in October, according to TeraHash data. At the same time, Bitcoin’s “hashprice” — the measure of expected revenue per unit of hashrate — fell nearly 12% month-to-date, pressured by the coin’s recent price weakness.

Rising Energy Costs Add to the Squeeze

Adding to miners’ challenges, surging global energy prices — particularly for oil and natural gas — have raised operating costs for both grid-connected and off-grid facilities. In some regions, including parts of the U.S. and Europe, operators have faced temporary power curtailments, further straining output.

“October was a remarkable month for Bitcoin mining, but profitability lagged behind hashrate growth,” TeraHash analysts told crypto.news. “We expect a short-term slowdown in November due to rising energy costs and seasonal weather constraints.”

Outlook: Short-Term Relief Ahead

The next Bitcoin network difficulty adjustment, expected later this month, could bring a slight decline in difficulty, offering temporary relief to smaller miners. However, with block rewards halving expected in April 2026, analysts warn that many marginal operators may face consolidation pressures in the coming quarters.

Despite profitability headwinds, Bitcoin’s surging hashrate reflects growing institutional-scale participation in mining and signals sustained long-term confidence in the network’s fundamentals.