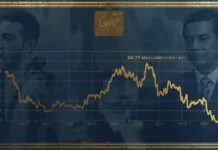

Dogecoin (DOGE) fell sharply on Monday, dropping by double digits to as low as $0.16, as the broader cryptocurrency market extended its recent weakness. The decline came amid renewed caution from the U.S. Federal Reserve over the outlook for interest rates.

Market Overview

At its lowest point on November 3, Dogecoin traded around $0.16, before recovering slightly to hover near $0.17. Despite the rebound, the leading meme coin remains down about 9% over the past 24 hours, and nearly 18% over the past week, according to data compiled by crypto.news.

The selloff coincided with steep drops across the crypto market, with Bitcoin (BTC) slipping to $105,366 and Ethereum (ETH) sliding to $3,564.

Dogecoin remains the 10th-largest cryptocurrency by market capitalization, valued at approximately $25.5 billion, but saw trading volumes surge 268% in 24 hours to over $3.3 billion, signaling intensified selling pressure.

Why Did Dogecoin Fall Today?

The market’s latest downturn followed comments from Austan Goolsbee, President of the Federal Reserve Bank of Chicago, who struck a cautious tone on the prospect of further rate cuts.

In a November 3 interview with Yahoo Finance, Goolsbee said he was “not in a hurry to cut interest rates further” while inflation remains above the central bank’s 2% target.

“I am nervous about the inflation side of the ledger, where you’ve seen inflation above the target for four and a half years, and it’s trending the wrong way,” he stated.

The remarks came just days after Fed Chair Jerome Powell signaled that a December rate cut was “not a foregone conclusion,” unsettling markets that had priced in a more dovish stance.

As a result, investors moved to reduce risk exposure, with equities, bonds, and digital assets all seeing declines. The crypto market, already fragile after October’s downturn, reacted swiftly to the shift in sentiment.

Analysts Eye $0.14 Support Zone

According to analysts at crypto.news, Dogecoin may face additional downside pressure if bearish sentiment persists. Technical charts indicate a potential move toward the $0.14 support zone, a level that previously served as a consolidation base in late September.

If the broader crypto market stabilizes and Bitcoin rebounds above the $107,000–$108,000 range, Dogecoin could attempt to reclaim the $0.18–$0.19 resistance band. However, near-term risks remain tilted to the downside given macroeconomic uncertainty and profit-taking by short-term traders.

The Bigger Picture

Despite its recent slump, Dogecoin continues to hold a strong position among top cryptocurrencies, buoyed by its active community and steady integration across trading and payment platforms.

Still, macroeconomic headwinds — particularly interest rate policy and liquidity tightening — remain key drivers of crypto volatility. As the Federal Reserve weighs its next move, traders may see heightened swings in meme coins like DOGE, which often amplify broader market trends.