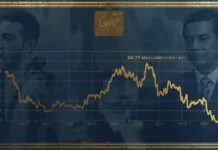

Gold-backed stablecoins are having a big year. In 2025, their total market value has climbed to nearly $4 billion, almost three times higher than it was at the start of the year.

Right now, two tokens dominate this space. Together, they control close to 90% of all tokenized gold. One of them has pulled ahead, taking about half of the entire market after steadily increasing its supply throughout the year.

This growth didn’t happen by accident. Gold prices have been rising strongly in 2025, driven by global uncertainty, political tensions, and worries about the economy. As gold became more attractive, demand for digital versions of gold followed the same path.

Gold-backed stablecoins allow people to own small pieces of real gold that is stored safely in vaults. These tokens move on blockchains, making them easy to trade, transfer, and use across borders, while still tracking the price of physical gold.

One major issuer has been buying so much bullion to back its tokens that it is now among the largest gold holders in the world, even ahead of some countries, based on international data.

All of this shows a clear trend: more investors are looking for assets that combine the safety of traditional commodities like gold with the speed and flexibility of digital finance. As uncertainty continues, tokenized gold is becoming a serious option for both everyday users and large institutions.