BitMart is showing stronger and more reliable liquidity in Bitcoin and Ethereum perpetual markets compared to other exchanges, and that’s good news for traders.

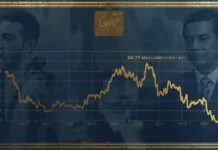

Recent market data shows that BitMart keeps a deeper order book for Bitcoin perpetuals across the top price levels. Even when the market moved up and down, BitMart’s liquidity stayed solid. Other exchanges, on the other hand, saw their order books thin out and recover more slowly.

The same thing happened with Ethereum perpetual markets. BitMart’s liquidity kept building over time, while many competing platforms showed flatter or uneven activity. This steady growth suggests BitMart isn’t just having a lucky moment—it’s maintaining consistency.

Why does this matter? A deeper order book means traders can place larger trades without pushing prices too much. That leads to tighter spreads, lower slippage, and smoother trade execution, especially during volatile market conditions.

When markets get shaky, thin liquidity can cause sudden price jumps. BitMart’s stronger depth helps reduce that risk, giving traders more confidence that their orders will fill close to the expected price.

Overall, the data suggests BitMart has invested heavily in market-making and trading infrastructure. Its consistent liquidity advantage in both Bitcoin and Ethereum points to a stronger and more stable trading environment compared to many rival exchanges.