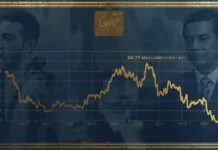

Bitcoin has dropped below $90,000, deepening a month-long slide that has now erased all of its gains for 2025 and shaken confidence across the entire crypto market.

The price fell as much as 2.4% during Asian trading hours and was last seen around $89,847. This continued the fall from its early-October high of more than $126,000 — a massive drop that has traders asking what comes next.

The last time Bitcoin traded around this level, it eventually plunged to about $74,400 in April when President Donald Trump’s tariff announcements shook global markets. Now, a new wave of economic worries is hitting the crypto space again. Traders are unsure about future interest rate moves, stocks are pulling back, and many are beginning to question whether speculative markets became too stretched. With risk appetite fading, Bitcoin has been feeling the pressure.

A brutal October selloff set the tone, wiping out more than $19 billion in liquidations and erasing over $1 trillion in total crypto market value. Retail traders, who usually buy the dip, have mostly stepped aside. Even speculative altcoins have seen far less activity. Data from Coinglass shows nearly $950 million in long and short positions liquidated in the past 24 hours alone.

Large holders and companies with significant Bitcoin positions are also feeling the heat. Firms like Michael Saylor’s Strategy Inc., which bought aggressively earlier in the year, now face pressure to re-evaluate their strategies as prices fall through key support zones.

So where does Bitcoin go from here?

Options traders are clearly preparing for more downside. There’s strong demand for protection at the $85,000 and $80,000 levels, showing that many expect the slide to continue.

But at the same time, some investors — including countries — are using the dip to accumulate more Bitcoin.

El Salvador, for example, just bought 1,091 BTC worth over $100 million. The country has been buying Bitcoin during downturns since it became legal tender in 2021, slowly building a long-term crypto reserve. With this new purchase, El Salvador now holds 7,474 BTC valued at roughly $688 million, making it one of the biggest national Bitcoin holders in the world.

For now, the market is watching to see whether Bitcoin can stabilize — or if more selling pressure will push it toward the next major support levels.