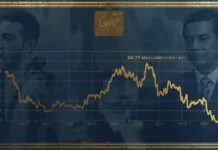

Bitcoin slid under $91,500 on Monday, extending a painful selloff that has now erased all year-to-date gains. Meanwhile, the total crypto market cap has plunged more than 30% since October 6, reflecting an increasingly fragile risk environment.

Summary

- Traders are heavily positioning for more downside, with options betting focused on $90,000, $85,000, and $80,000 strike levels.

- Market sentiment has collapsed into “extreme fear”, the lowest reading since July 2022.

- Corporate crypto treasuries face mounting pressure to sell — though El Salvador bought 1,091 BTC worth over $100M during the dip.

- Concerns over Nvidia earnings, weakening tech stocks, and uncertain Federal Reserve rate-cut policy are weighing down risk appetite.

Options Market Signals Traders Expect More Declines

According to Bloomberg, traders in the derivatives market are aggressively hedging against further losses. Demand for downside protection has spiked, especially near:

- $90,000

- $85,000

- $80,000

Options expiring this month are seeing the highest volumes, fueled by over $740 million in bearish contracts — far surpassing bullish speculation seen just weeks ago when Bitcoin flirted with its yearly highs.

The shift reflects a dramatic change in sentiment: the wealthy buyers who typically support Bitcoin’s momentum have retreated, and the market now expects an extended downturn.

Social Media Turns Bearish as Fear Surges

Markets opened the week with pessimism dominating social media discussions. Many traders describe the price action as “messy,” “ugly,” and “just the beginning.”

The Crypto Fear Index from CoinMarketCap dropped to 9, signaling extreme fear — its weakest level in more than three years.

This collapse in sentiment has created a psychological gridlock:

- Many investors are deep in losses and unwilling to buy more.

- Yet they’re also too uncertain to sell, fearing a recovery might follow.

This “frozen” mindset is keeping volume and liquidity weak across the major exchanges.

Corporate Treasuries Under Pressure

The sharp decline is hitting corporate crypto treasuries hard — especially firms that leveraged their Bitcoin holdings earlier in the year.

- Michael Saylor’s Strategy Inc. recently added $835 million worth of Bitcoin.

- But other corporate treasuries are being forced to consider selling assets to stabilize their balance sheets.

This wave of forced selling contributes to a self-reinforcing downward spiral, where each drop in price triggers more pressure to liquidate.

El Salvador Buys the Dip — Again

While many institutions hesitate, El Salvador has once again stepped in during market weakness.

The country purchased 1,091 BTC, worth over $100 million, bringing its total holdings to:

7,474 BTC

≈ $688 million

Since adopting Bitcoin as legal tender in 2021, El Salvador has followed a simple strategy: accumulate during downturns and build a sovereign digital-asset reserve.

Some analysts have jokingly referred to the country as “exit liquidity”, given its repeated purchases while major funds reduce exposure.

Broader Economic Pressures Drag Down Crypto

The crypto downturn is also tied to broader macroeconomic concerns:

1. Nvidia Earnings on Wednesday

Nvidia’s performance is a major sentiment driver for tech and speculative assets. Any disappointment could worsen selling in crypto.

2. Federal Reserve Rate-Cut Uncertainty

Markets are recalibrating expectations for a potential December rate cut, reducing demand for high-risk assets.

3. Stock Market Weakness

The S&P 500 dropped over 1%, adding pressure on crypto, which often mirrors moves in tech.

4. Heavy Liquidations Since Early October

A wave of forced selling in early October — wiping out $19 billion in digital assets — continues to haunt the market.

Open interest in crypto futures has fallen sharply:

- Solana’s OI has halved, showing a mass exit from speculative altcoin positions.

- Ethereum dropped to $2,975, now down 24% since early October.