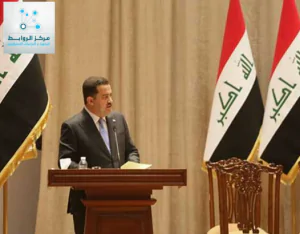

When compared to the same time period in 2023, the first months of 2024 have seen significant shifts in Iraq’s revenues and expenditures. This is a reflection of the economic changes that are being led by Iraqi Prime Minister Mohammed Shia al-Sudani and his government. This examination plans to survey these progressions and evaluate their effect on the Iraqi economy.

Oil and non-oil revenues from Iraq: The contribution of oil revenues is expected to fall from 99.23% in 2023 to 89.1% in 2024, according to the data. The government’s success in increasing non-oil revenues, which clearly reflects efforts to diversify income and lessen reliance on oil, is responsible for this decrease.

Revenues from income and wealth taxes: The income and wealth tax contribution went up from 1.44 percent in 2023 to 2.1% in 2024. This rise is indicative of the success of government policies in this area, as it reflects increased economic activity and improved tax efficiency in Iraq.

Excise duties and commodity taxes: These revenues increased significantly, going from 0.87 percent in 2023 to 2.4 percent in 2024. This increment shows an unmistakable improvement in the duty framework and an expansion in charge consistence, which upgrades the public authority’s part in giving the fundamental assets to improvement.

Second: Current and investment expenditures for Iraq:

Investment expenditures decreased from 12.6% in 2023 to 10.0% in 2024, despite an increase in current expenditures of 87.4% in 2023 and 90.0% in 2024, respectively. This shift reflects the financial difficulties the government faces, which could be brought on by the need to finance the deficit or shift spending away from other priorities.

Diversification of Revenue and Economic Analysis: The government’s strategy to diversify sources of income, which enhances the stability of the Iraqi economy and shields it from fluctuations in global oil prices, is reflected in the rise in non-oil revenues.

Problems with spending: There are still difficulties in directing spending, despite the increase in revenues. The government will need to rethink its fiscal strategies in order to better allocate resources as a result of rising debt service spending and decreasing investment spending, both of which may impede sustainable development.

The Iraqi economy’s future: Assuming that the public authority proceeds with its endeavors to support non-oil incomes and further develop use the board, the Iraqi economy is supposed to observe more steady development before very long. However, in order to achieve sustainable economic development, it is necessary to address issues such as managing public debt and directing spending toward more productive industries.

In conclusion, the beginning of 2024 marks a significant turning point for the Iraqi economy because, despite ongoing difficulties managing spending, the government has been successful in diversifying revenues. To ensure a better future for Iraq and increase economic stability, it will be essential to continue these reforms.

Financial Investigations Unit/North America Office