Ethereum Trades Near Key Demand Zone as Long-Term Holders Increase Accumulation

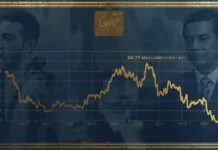

Ethereum is trading near a critical demand area as volatility continues to shake the broader crypto market, new on-chain data shows. The second-largest cryptocurrency by market value is hovering just above short-term support after several weeks of sustained selling pressure.

Summary

- ETH near key support: Ethereum is trading close to short-term structural support, currently sitting about 8% above the Accumulation Addresses Realized Price, a key cost-basis metric for long-term holders.

- Long-term accumulation surges: More than 17 million ETH flowed into accumulation addresses in 2025, raising their total holdings from 10 million to over 27 million ETH.

- Mixed technical signals: ETH remains above the 200-week moving average (major support), while the 50-week moving average acts as resistance. A breakout from either side may define the next major trend.

ETH Price Nears Support as Market Weakness Persists

Ethereum is currently priced at $2,967.76, down 23.4% over the past month, according to CoinGecko. Despite the decline, the asset remains approximately 8% above the Accumulation Addresses Realized Price — a metric representing the average on-chain cost basis of long-term Ethereum buyers, per CryptoQuant analyst Burak Kesmeci.

Accumulation addresses typically acquire ETH during periods of market stress, making this metric a strong indicator of long-term investor confidence. Historically, Ethereum has dipped below this level only once, during April 2025, when global economic uncertainty spiked sharply.

The Global Economic Policy Uncertainty Index (GEPUCURRENT) rose that month to levels even higher than those recorded during the peak of the COVID-19 pandemic, underscoring the severity of the macroeconomic environment at the time.

Long-Term Holders Expand Holdings Despite Volatility

Despite turbulence across crypto markets this year, accumulation continues at a notable pace:

- 17 million ETH flowed into accumulation wallets in 2025.

- Total ETH held in these addresses rose from 10 million to more than 27 million ETH.

This trend signals that long-term holders — often considered the “smart money” cohort — continue to build exposure even as short-term sentiment weakens.

Market analysts note that this behavior typically aligns with periods when Ethereum trades near major structural support zones.

Technical Picture: Support Holds, Resistance Above

Technical analysis of Ethereum’s weekly chart shows a market stuck between two key moving averages:

1. 200-week Moving Average (Support)

ETH is holding above the 200-week MA — historically a reliable indicator of long-term bottoms. The price briefly slipped below this level last week before reclaiming it, suggesting strong demand in the area.

2. 50-week Moving Average (Resistance)

Just above the current price sits the 50-week MA, which has acted as firm resistance. A breakout above this level would signal improving momentum and could shift market sentiment.

If Ethereum breaks below the nearby structural support, analysts warn it could retest the Accumulation Realized Price area highlighted by CryptoQuant — where long-term buyers may again step in.

Current Setup Resembles Prior Recovery Phases

Market observers are comparing the present structure with earlier correction periods, including April 2025, when ETH tested long-term support before staging a recovery.

The combination of on-chain accumulation trends, key support levels, and historically reliable moving averages suggests that:

- Long-term holders are actively watching current levels, and

- Institutional participants may reenter if ETH maintains strength above major support.

As the market digests ongoing macro volatility, Ethereum’s ability to hold this zone will likely shape the next major move.