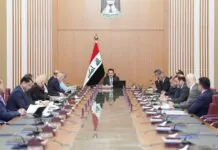

Iraqi high Minister Mohammed S. Al-Sudani announced collection of banking zone reforms on Friday.

the main adjustments consist of growing the quantity of financial institution branches, more adoption of new era, and a marketing campaign to educate the public about banking and monetary offerings.

full declaration from the Media office of the prime Minister:

As a part of efforts to reform the financial and banking device, a concern of the authorities’s software, and given the development made over the past two years, as well as the demanding situations presently going through the economic and banking sectors, particularly within the provinces, prime Minister Mohammed S. Al-Sudani has directed numerous measures to deal with those challenges, enhance believe in the economic and banking sectors, facilitate financial improvement, and growth economic inclusion national. This movement is essential because maximum efforts have been concentrated in Baghdad.

The directives consist of:

- growing the wide variety of bank Branches: increase branches in the provinces to meet local wishes, improving get entry to to monetary offerings, with interest to fashionable buildings and important facilities.

- Adopting contemporary technologies: ensure that every one provincial banks adopt modern technology inclusive of on-line banking and cellular applications, making it less complicated for residents to get right of entry to their banking offerings.

- three. growing monetary services: Emphasize the importance of banks enhancing economic offerings to satisfy the needs of individuals and small groups, consisting of presenting affordable loans and savings debts.

- improving financial Inclusion: offer banking services across numerous community segments, which include districts, sub-districts, and rural areas.

- Launching attention Campaigns: arrange conferences and consciousness campaigns within the provinces to train citizens at the significance of banking, economic management, and funding.

- education Workshops: conduct workshops to teach young marketers and local enterprise leaders on coping with loans and economic services correctly.

The Ministry of Finance, the valuable financial institution of Iraq, and the associations of personal and Islamic Banks will coordinate with provincial governors to implement those measures in line with their roles and duties. Quarterly development reviews (every 3 months) may be submitted to the high Minister’s office on the fame of these tasks.