As a component of the continuous endeavors of the National Bank of Iraq to find productive understandings with the US of America in regards to unfamiliar exchanges and safeguarding the Iraqi financial framework from sanctions, a designation from the National Bank held serious discussions in New York.

In order to enable Iraqi banks to complete their financial transactions, whether through foreign transfers in US dollars or other foreign currencies, the talks included expanding the network of international correspondent banks and qualifying Iraqi banks to meet the necessary requirements to open accounts with international correspondent banks.

Monetary and banking specialists depicted the visit as “productive”, considering the fulfillment of worldwide accomplices with the course of the National Bank’s work during the previous period, and the development of monetary exchanges.

Financial master Nabil Jabbar Al-Tamimi told Al-Sabah that the Iraqi Bank’s visit to the US of America included dropping the stage toward the finish of this current year, as well as attempting to begin moves to private manages an account with huge banks.

That’s what he added “this visit isn’t the first of its sort,” making sense of that these understandings offer the Iraqi financial framework a chance to make banking changes and enhancements, empowering Iraq to set up the circumstances and abilities to incorporate with the worldwide financial framework.

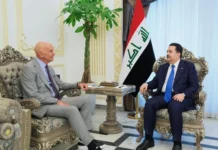

Since the 26th of this month, a delegation from the Central Bank, led by Governor Ali Al-Alaq and including a number of general managers, has been in the United States to discuss developments in the banking sector and the restrictions on the use of the dollar that a large number of private banks have imposed.

In a statement to Al-Sabah, financial and banking expert Mustafa Akram Hantoush stated: Correcting the status of the sanctioned Iraqi banks and working to open accounts with correspondent banks over the next few months were among the topics of discussion.

He went on to say that the agreements also included using regulatory mechanisms to conduct external transfer operations through 13 Iraqi banks using the euro, Chinese yuan, Indian rupee, and Emirati dirham.

The National Bank reported in a proclamation gave last Saturday that an arranging designation held a progression of escalated gatherings in New York City, USA, which included conversations with the US Depository Division and the Central Bank, notwithstanding gatherings with a gathering of organizations (Visa, Mastercard and MoneyGram) as well as banks (Citi Bank and JP Morgan) as well as worldwide reviewing firms (KPMG, E&Y, K2i and Oliver Wyman).

He added that the members in the gatherings commended the significant changes accomplished by the National Bank of Iraq, which address an uncommon accomplishment at the nation level, as the bank accomplished wonderful advancement in observing strategies for unfamiliar exchanges and money deals of the US dollar, which prompted further developing frameworks, approaches and methods as per global and neighborhood norms, improving straightforwardness in covering unfamiliar exchange and giving security to the banking and monetary area from the dangers of tax evasion, fear based oppressor funding and monetary wrongdoings.

According to the plan that this bank established and implemented internationally, the Central Bank of Iraq and the Federal Reserve Bank will be able to exercise their supervisory roles away from executive procedures. The Central Bank made the announcement in the statement that a meeting will be held between the officials of the Central Bank of Iraq and its international partners by the end of this year regarding the major transformation of ending the work of the electronic platform for foreign transfers and replacing it with direct banking relations between Iraqi banks and the network of international correspondent banks.

He explained that this change will have a big impact on the stability, fluidity, and transparency of the country’s foreign trade financing operations. He also said that the goal is to get the necessary stability in exchange rates, which will make the Iraqi financial system work better.

The Central Bank said that the meetings in New York City also talked about ways to expand the network of international correspondent banks and get Iraqi banks to meet the requirements to open accounts with international correspondent banks so they can finish their financial transactions, whether they’re in US dollars or another currency.