Good Afternoon ,

SEC COMMISSIONER DISSENTS ON AGENCY’S MEMECOIN STANCE

Commissioner Caroline Crenshaw said that the agency’s working definition of memecoins was vague and could be easily misconstrued.

US Securities and Exchange Commission Commissioner Caroline Crenshaw issued a dissenting opinion on the SEC’s recent stance that memecoins are not securities.

According to the commissioner’s Feb. 27 statement, memecoins could satisfy the Howey test’s condition of profiting from the managerial efforts of others due to the coordination between developer teams and promoters.

The commissioner added that most, if not all, cryptocurrencies could be defined as memecoins under the SEC’s recent guidance, which was released on the same day. In this guidance, the agency stated that memecoins represent online social trends with speculative value and high volatility — and are not securities. Commissioner Crenshaw, however, has a different viewpoint:

“Today’s statement paints meme coins as cultural projects whose purpose is entertainment and social engagement. The reality is that meme coins, like any financial product, are issued to make money.”

Memecoins have come into sharper focus following several high-profile scams, hacks and even presidential memecoin launches that threaten the long-term viability of the sector and invite scrutiny from state officials.

US regulators and lawmakers attempt to reign in memecoins

Following US President Donald Trump’s memecoin launch, several Democrat lawmakers, including Elizabeth Warren, called for an investigation into potential ethics violations of the presidential token.

On Feb. 27, California Member of Congress Sam Liccardo announced that House Democrats are prepping a bill that would ban presidential memecoins.

The proposed bill, titled “The Modern Emoluments and Malfeasance Enforcement (MEME) Act,” would prohibit US lawmakers from sponsoring, issuing or endorsing any digital asset.

Moreover, spouses and dependents of US representatives, the president, vice president and senior executive branch officials are also prohibited from issuing or sponsoring memecoins under the bill.

Attorney Elizabeth Davis, former chief attorney at the Commodity Futures Trading Commission (CFTC), recently argued that memecoins should be regulated by the CFTC.

Davis told Cointelegraph that if the commodities regulator is granted regulatory oversight over crypto, then there is a strong likelihood that memecoins will be included in their purview.

The attorney also expressed confidence that comprehensive memecoin regulations would be established in the United States over the next year — putting an end to the regulatory ambiguity surrounding social tokens.

@ Newshounds News™

Source: CoinTelegraph

~~~~~~~~~

ARIZONA APPROVES BITCOIN RESERVES, BUT WYOMING AND MONTANA ARE SAYING NO – HERE’S WHY

▪Arizona advances crypto legislation – two bills, one establishing a digital asset reserve and another focused on Bitcoin investment

▪While Arizona embraces crypto reserves, other states like Wyoming and Montana reject them due to volatility concerns.

▪Bitcoin’s recent price drop fuels skepticism, while predictions suggest federal crypto legislation is forthcoming.

Arizona is pushing ahead with cryptocurrency investment as two Bitcoin reserve bills have passed the Senate, setting the stage for final approval in the state’s House of Representatives.

While states like Wyoming and Montana are rejecting similar measures over concerns about crypto’s volatility, Arizona is doubling down on digital assets.

If these bills pass in the state’s House of Representatives, Arizona could become one of the first states to officially hold Bitcoin in its reserves.

Senate Approves Bitcoin Reserve Bills

On Feb. 27, the Arizona Senate approved the Strategic Digital Assets Reserve bill (SB 1373) in a 17-12 vote, sending it to the House for final approval. Sponsored by Republican Senator Mark Finchem, the bill aims to create a Digital Assets Strategic Reserve Fund, which will be managed by the state treasurer. The fund will include legislative appropriations and crypto assets seized by the state.

To limit risk, the treasurer would be allowed to invest no more than 10% of total fund deposits per fiscal year. However, the state could loan out digital assets to generate returns as long as it doesn’t add financial risk.

Another Bill Aims to Allow Bitcoin Investments

A second Bitcoin-related bill is also moving forward. The Strategic Bitcoin Reserve Act (SB 1025), co-sponsored by Republican Senator Wendy Rogers and Representative Jeff Weninger, passed the Senate with a 17-11 vote.

Unlike Finchem’s bill, which focuses on managing seized crypto assets, SB 1025 allows the state to invest public funds directly into Bitcoin and other cryptocurrencies. This signals Arizona’s growing commitment to incorporating digital assets into its financial strategy.

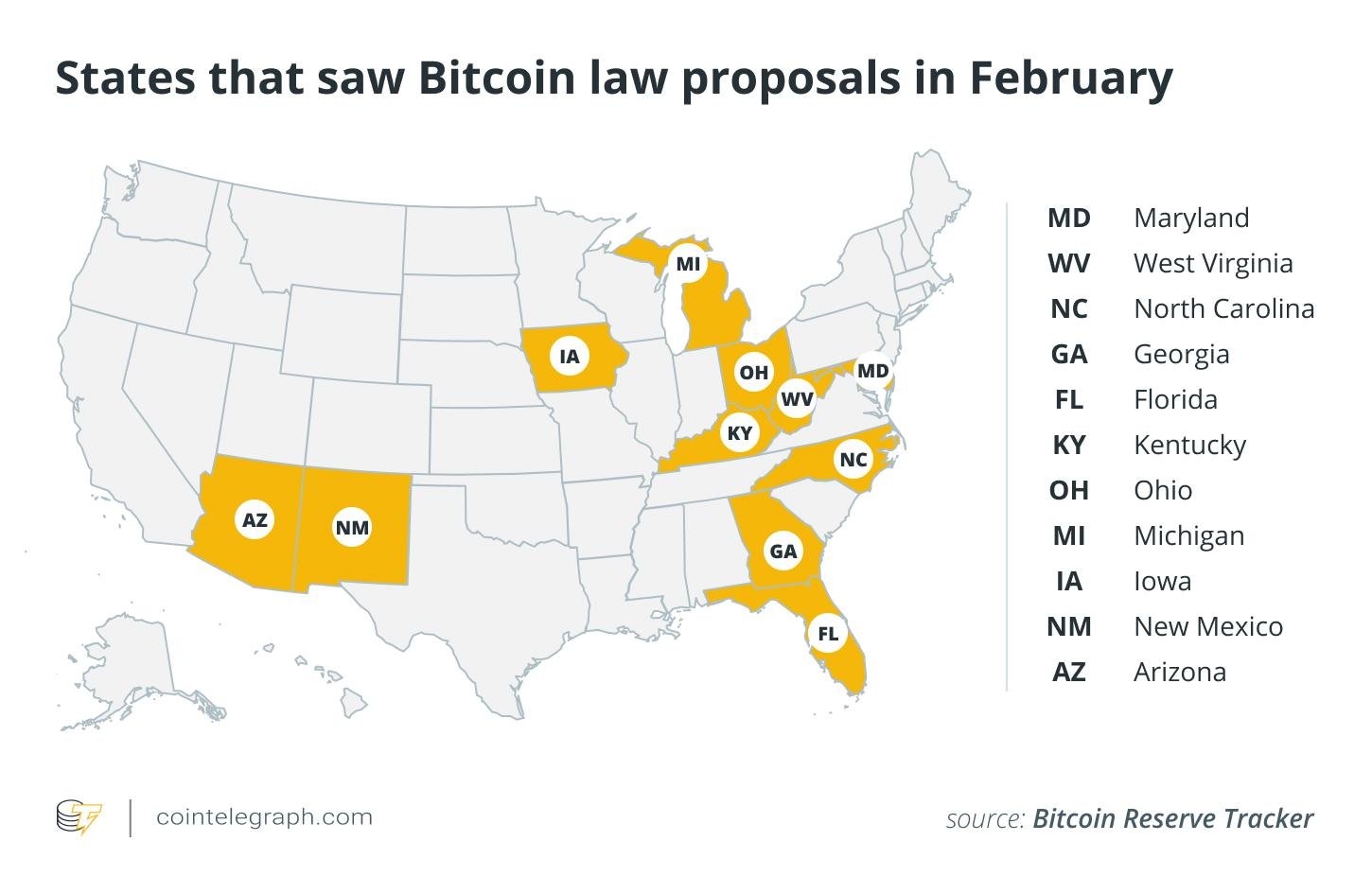

Crypto Legislation Gaining Momentum Nationwide

Dennis Porter, founder of Satoshi Action Fund, believes federal regulation of cryptocurrencies is inevitable. He predicts lawmakers will first regulate stablecoins, followed by broader market structure rules, and eventually, Bitcoin reserves.

While Arizona and Utah are leading the push for crypto reserves, 18 other states are still waiting for approval. However, not all states are on board—Montana, Wyoming, and others have rejected similar plans, calling Bitcoin too risky.

Trump Weighs Heavy on the Markets

Despite increasing political support for crypto, Bitcoin’s price has taken a hit. The asset dropped below $80K, and analysts fear it could fall further to $70K–$75K. Bitcoin is down 17% this week, with Trump’s tariff policies adding to market uncertainty.

Amid the panic, Michael Saylor jokingly told investors to “sell a kidney if you must, but keep the Bitcoin.” While Saylor continues to advocate for a U.S. Bitcoin reserve, the recent price drop has given skeptics more reason to doubt Bitcoin’s long-term stability.

@ Newshounds News™

Source: Coinpedia

~~~~~~~~~

FEBRUARY IN CHARTS: SEC DROPS 6 CASES, MEMECOIN CRAZE COOLS AND MORE

@ Newshounds News™

Read the story: CoinTelegraph

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound’s Podcast Link

Newshound’s News Telegram Room Link

Q & A Classroom Link

Follow the Roadmap

Follow the Timeline

Seeds of Wisdom Team™ Website

Subscribe to Seeds of Wisdom Team™ Newsletter