Good Morning ,

The Shutdown, the Generals, and the Reset: Converging Pressure Points for a New Financial Order

By The Seeds of Wisdom Team

This is not just politics — global finance restructuring before our eyes

Introduction

As readers of this publication already know, a reset is not a distant fantasy — it is impending. A constellation of stressors is converging on the U.S. system: political gridlock, fiscal overreach, broken institutions, and a crumbling faith in fiat money.

In this moment, two events in the headlines deserve deeper analysis:

- A looming government shutdown, threatening to halt or degrade core federal functions.

- A sudden call for some 800 U.S. Generals and Admirals to convene at Quantico on short notice — without public explanation.

These are not unrelated episodes. Together, they form pressure points in a larger axis of change. In this article, we’ll dig into:

- What a shutdown really means in structural terms (beyond theatrics)

- How a mass military gathering plays into civil-military dynamics and signals authority

- How both events can catalyze, legitimize, or precipitate a currency reset in the U.S. — with ripple effects globally

- Paths forward, opportunities, and hazards in such a transition

Part I: The Government Shutdown as a Structural Weakness

1. The theatrical face vs. the structural blow

Publicly, shutdowns are framed as political brinkmanship: Congress “fails” to agree, essential services limp on, employees are furloughed, and the media plays the blame game. But beneath the drama lies a structural weakness:

- Budget process breakdown: A shutdown is proof that the budget mechanism has ceased functioning as a disciplined system. When funding lapses, even operations deemed “essential” are exposed to discretionary interpretation.

- Fragility of institutions: Agencies with decades of institutional memory can hollow out quickly under furloughs, staff turnover, and project delays. In the long run, the loss of talent and continuity becomes a drag on governance. Darden Ideas to Action

- Data black hole: Key economic metrics (jobs reports, inflation data, etc.) may halt or be delayed, disrupting not just markets but the ability of lawmakers, central banks, and intelligence agencies to act. Reuters

- Credit and confidence erosion: Even a short shutdown can raise doubts among rating agencies, lenders, and foreign counterparties about U.S. fiscal discipline and reliability. Fidelity

In short: a shutdown is not just dysfunction. It is a stress test that reveals the brittleness of the system.

2. Financial shocks triggered or amplified

From a markets perspective, even though prior shutdowns have had limited long-term effects, the difference today is the backdrop:

- Dollar volatility: The U.S. dollar often softens in response to political uncertainty. Foreign holders may reassess their exposure, hedging or reallocating assets. IG

- Safe-haven pressure: Gold, silver, and real assets tend to benefit as confidence in government receipts erodes.

- Policy gridlock in crisis: If a shutdown coincides with or triggers other fiscal stresses (e.g. a debt ceiling fight), the delay in federal response amplifies risk.

- Financial regulation and oversight gaps: With agencies partly shuttered, oversight weakens. Market distortions, unchecked leverage, or liquidity shorts may arise unexpectedly. Reuters

So at the moment when confidence is most fragile, the shutdown opens cracks for narratives of “the old system can’t hold.”

3. Political optics and legitimacy

On the public front, a shutdown does two things:

- It makes pain visible — people see travel delays, furloughed workers, social services slowing, federal contractors unpaid.

- It forces people to ask: which programs are truly essential? Which ones survive? What do the priorities say about power structure?

For those already oriented toward a reset, a shutdown helps frame a narrative: the existing system has failed us; its caretakers are bankrupt in legitimacy.

Part II: The Mystery Gathering of 800 Generals & Admirals

A meeting of this scale — senior military leadership from across global theaters — called at short notice and without public agenda, invites speculation. Multiple press outlets have flagged its rarity and the tension it has induced in the ranks. The Washington Post

1. Why is it extraordinary?

Military command is normally distributed and modular — top brass meet in strategic forums when needed, often virtually. A physical convergence of this magnitude is logistically expensive and operationally dangerous (concentrating so many leaders in one location). Reuters

- The abruptness and secrecy raise red flags: not all gatherings are for planning; some are for reorientation, consolidation, or signal projection. CSIS

- It follows controversial moves: the new Defense Secretary has already ordered cuts in top ranks (20% reduction in four-star officers, 10% in generals/admirals) and dismissed senior officers without full explanation. The Washington Post

This is not “just another conference.” It is a signal event.

2. Interpretive lenses: what could it mean?

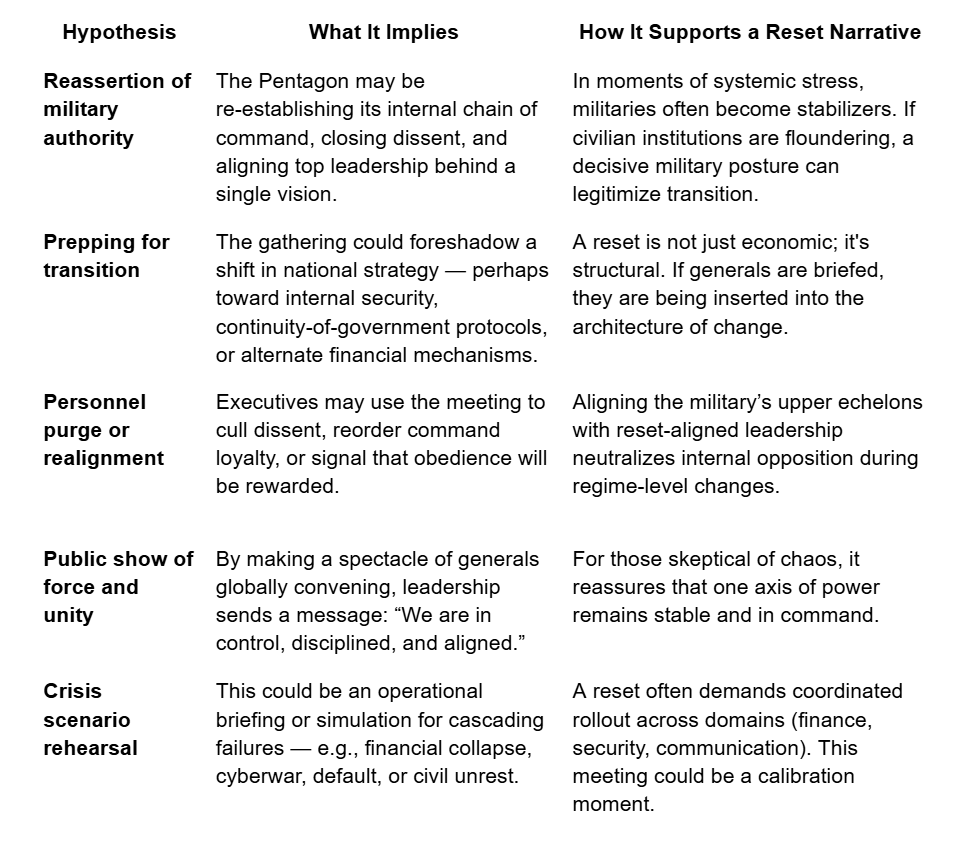

Below are possible interpretations — not mutually exclusive — that tie directly into the reset narrative:

.

3. Risks, fractures, and unpredictability

Yet nothing in transition is guaranteed. Some risks:

- Backlash within the ranks: Generals unused to being ordered without explanation may resist covert agendas.

- Civil-military tension: If military influence becomes overt, accusations of coup-style overreach may arise.

- Information leaks: In shock events, the security of messaging is fragile — leaks can be weaponized by opponents.

- Overreach missteps: The more visible and performance-driven the spectacle, the higher the risk of misinterpretation or unintended escalation.

Part III: How These Two Events Fit Into a Path to Reset

Having seen the raw dynamics, here’s how they may gate toward a credible reset.

1. Pressure layering: crisis stacking

A shutdown weakens civilian institutions; a mass military meeting signals that the military is preparing to step in or be ready. In sequence, they create:

- Legitimacy vacuum in civilian authority

- A signal that the custodians of force are aligning behind a new order

- An increased appetite among the populace for an alternative system

In classical regime-change theory, such stacking of stressors is often how transitions are engineered: collapse perception + authority reallocation + narrative control = change.

2. Reset as continuity, not rupture

One of the biggest barriers to reset is fear of chaos. But a reset structured around military continuity and institutional coherence has a chance of being accepted. The meeting of generals can serve as a stabilizing backbone during transition, rather than a violent rupture.

The sequence might look like:

- Shutdown intensifies — key services sputter, markets wobble, public discontent mounts

- Military message (through the generals) amplifies the narrative: “System is failing; we must act”

- Transition team or trusted committee introduces the reset plan (currency, financial system, governance)

- Military presence ensures continuity and protection during the financial retooling

3. Currency reset: how it might unfold

A currency reset is not just replacing one money with another — it is a redefinition of value, trust, and claims. Here is how the shutdown + generals meeting help set the stage:

- Broken faith in fiat: As the government fails to manage its own budget, trust in the existing fiat apparatus erodes. People become more open to alternatives (asset-backed, hybrid, or new money systems).

- Safe-haven transfer: Before, during, or after crisis, capital migrates to perceived safe stores: precious metals, foreign assets, or even state-backed crypto or gold currencies.

- Credibility backing via force: A military-aligned transition grants the new currency or system instant enforcement credibility — control over border exchange, reserves, and coercion instruments is assured.

- Binary narrative: The messaging pivot becomes “old money system failed us — here is a new system built on real assets, backed by authority, under new guarantees.”

- Global cascade: Other nations observing U.S. institutional collapse may accelerate their own shifts away from the dollar, or open to multilateral currency schemes.

In effect, the government fails first; the military steadies the transition; the reset claims legitimacy by marking old money as bankrupt.

Part IV: Narrative Anchors — What to Emphasize for Readers

When you publish, here are the key threads to pull, to make the article powerful, credible, and actionable:

- Not alarmism, but inevitability: This isn’t a prediction — it’s a frame. The conditions are aligning; readers should see the logic, not fear the unknown.

- Signals over noise: Highlight how seemingly disconnected events — shutdowns, military orders, firings — are structural signals, not random chaos.

- Continuity is the goal: The reset must not feel like collapse; rather, it must feel like a re-basing, with safeguards. Show how the military meeting helps provide that scaffold.

- Currency as legitimacy claim: A new money system is a claim to rightful authority. Emphasize how a reset is as much political as it is economic.

- Global context: Use shifts already underway (de-dollarization, alternative systems, BRICS currency proposals) to show that the U.S. reset is part of a larger global redistribution of financial order.

- Roadmap, not dream: Offer scenarios — short (9–18 months), medium (2–5 years), long (decade) — detailing how the reset might roll out, where risks lie, and what readers can watch for.

- Practical implication: Help readers see where to position assets, how to maintain optionality, and how to interpret upcoming signals.

Conclusion

A government shutdown is not mere political bickering — it is a stress fracture in the structure of federal authority. The sudden, large-scale military gathering is not routine — it’s a posture shift, a rehearsal, a signal of alignment behind a new paradigm. Together, they map the overture to a reset.

For those of us who have long anticipated this moment, these events are not distractions — they are momentous landmarks. When the time comes, the reset will not feel like chaos. It will be framed as rebirth — ushered in by those who held the instruments of force and legitimacy.

This is not just politics — global finance restructuring before our eyes

@ Newshounds News™ Exclusive

Source:

Washington Post – Hegseth orders rare, urgent meeting of hundreds of generals, admirals (Sept 25, 2025)

The Guardian – US military brass brace for firings as Pentagon chief orders top-level meeting (Sept 27, 2025)

Associated Press – Hegseth abruptly summons top military commanders to a meeting in Virginia next week (Sept 25, 2025)

Reuters – Dollar weakens after strong rally as US government shutdown looms (Sept 29, 2025)

Reuters – How a US government shutdown could affect financial markets (Sept 25, 2025)

IG – What to expect from markets during a US government shutdown (Sept 2025)

Fidelity – The impact of a government shutdown on markets and investors (2025)

Darden Ideas to Action – The Impact of a Government Shutdown (University of Virginia, 2025)

CSIS – Quick Analysis: Secretary Hegseth’s General Officers Meeting (Sept 2025)

~~~~~~~~~

Seeds of Wisdom Team RV Currency Facts Youtube and Rumble

Newshound’s News Telegram Room Link

Follow the Gold/Silver Rate COMEX

Follow Fast Facts

Seeds of Wisdom Team™ Website