The Governor of the Central Bank of Iraq, Ali Al-Alaq, announced on Monday that the interest rate for funds deposited in banks has been increased to 7.5%. This move is aimed at encouraging citizens to deposit their money in banks instead of keeping it outside, and to reduce the amount of cash circulating outside the banking system. The Ministerial Council for the Iraqi Economy is also considering raising the interest rates on deposits.

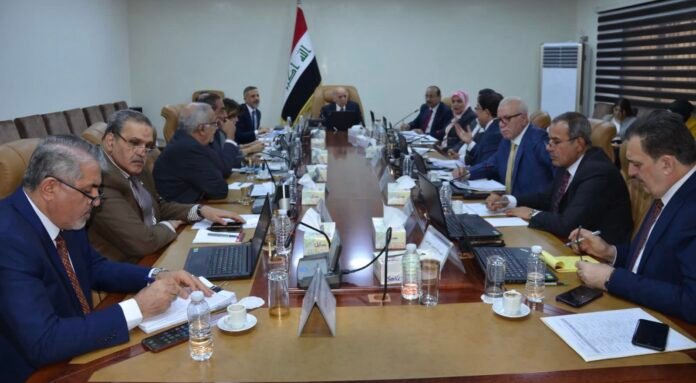

This event occurred during the presidency of Iraqi Foreign Minister Fuad Hussein. It was the 31st session of the Ministerial Council for the Economy, and was attended by the Ministers of Planning, Finance, Labor and Social Affairs, the Secretary-General of the Council of Ministers, the Governor of the Central Bank, the Undersecretary of the Ministry of Oil, the Vice-President of the National Investment Authority, the Chairman of the Securities Commission, and advisors to the President, including Ministers for Economic and Legal Affairs.

Shafaq News Agency received a statement indicating that the Council hosted the Chairman of the Finance Committee in the Iraqi Parliament, Atwan Al-Atwani, and several committee members to discuss dollar exchange rates in Iraqi markets.

The Governor of the Central Bank of Iraq, Ali Al-Alaq, provided a detailed explanation of the tasks and objectives of the Central Bank and monetary policy in Iraq.

According to the statement, Al-Alaq emphasized that the exchange rate in Iraq is largely dependent on imports rather than local production. He also mentioned that the exchange rate in Iraq has unique characteristics due to its correlation with the price of oil, which is the primary source of hard currency in the country.

He explained that there are many factors that affect the exchange rate. The most important of these factors include the leakage of the dollar to neighboring countries, internal trading in local markets using a currency other than the national currency, as well as the lack of complete control over ports and smuggling.

Al-Alaq stated that imports are covered by official prices, resulting in price stability for goods.

The Governor of the Central Bank announced the establishment of a designated lounge at Baghdad International Airport for private banks to sell dollars to travelers. Additionally, the interest rate for bank deposits has been raised to 7.5% as a means of encouraging citizens to deposit their money in banks instead of holding onto cash. This move aims to reduce the amount of cash circulating outside of banks.

Following objective and thoughtful discussions, Fouad Hussein, the head of the Ministerial Council for the Economy, stated that the council will carefully examine the important matter of salary localization for all government, mixed sector, and private sector workers. They will ensure that all workers receive fair compensation for their work.

Hussein stated that the Ministerial Council would examine the possibility of raising the interest rate on deposits. He added that they aim to develop essential tools for the Central Bank and the Ministry of Finance that align with the requirements of their respective roles.