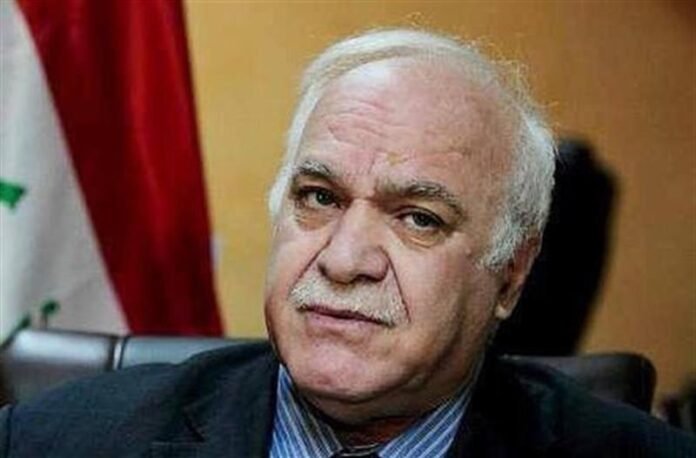

The financial advisor to the Prime Minister, Mazhar Muhammad Salih, confirmed on Tuesday that Iraq will announce its entry into the advanced digital era in early 2024.

Saleh informed the official agency that Prime Minister Muhammad Shiaa Al-Sudani’s government curriculum focused on two main objectives related to reforming work principles in public administration. The first objective was to eliminate corruption in general and systemic corruption in particular, the most dangerous type of corruption affecting the executive branch. The second objective was to increase the state’s non-oil revenues and ensure that their percentage in the federal general budget estimates is at least 20% instead of their current low percentages of about 10% or even less. This would help achieve the goals of the ongoing reform years.

“He added that non-oil revenue agencies, such as customs and tax authorities, border crossings, and others, are leading the way in financial and administrative reforms. According to international indicators, there are three main challenges that hinder countries in their efforts to combat financial and administrative corruption. These challenges can be summarized as follows: first, dealing with paper documents and direct human communication in transactions; second, the risks associated with direct cash payments for settling taxes; and third, the lack of digital systems for managing transactions without human intervention.”

Saleh explained that in order to achieve the government’s goal of reforming and replacing non-oil revenue systems with digital ones, a new digital program is being rapidly adopted. This program is based on assessment, examination, and electronic collection without direct human intervention. It will be implemented using advanced digital systems developed by national and international companies, with support from the United Nations Development and Trade Organization. Specifically, this program will focus on developing digital systems for border crossings, customs, and taxes. By early 2024, Iraq will have entered the advanced digital era, thanks to this initiative. An official announcement will be made soon.

He emphasized the importance of replacing traditional payment systems with digital ones, starting with the government’s collection of digital payments and extending to all economic activities, big or small. This transition would mark the beginning of a new digital era for Iraq. He also stated that the faster adoption of electronic payments is necessary for the banking system to function safely and effectively. Digital payment systems allow banks to have a better understanding of daily flows and balances, which reduces liquidity risks. With this information, banks can offer more flexible cash demand functions without worrying about shrinking liquidity or anticipating its loss. This is especially crucial during times of uncertainty, where digital payment systems can help to support economic activity and accelerate financing.

He emphasized that with the advent of digital banking, all such phenomena are likely to disappear, and the risks associated with cash liquidity will decrease significantly. Digital systems provide a high level of certainty in the flow of money, thereby reducing the risks associated with transactions between the public and banks. The digital payments system is characterized by strong governance and financial transparency, meeting the needs of the growing economic business sector. It eliminates doubts and hesitations imposed by liquidity risks due to a lack of information.

Saleh has pointed out that there is a connection between financial inclusion and the development of digital payments. Financial inclusion involves providing banking services to the economically weakest sections of society. Digital payments play a crucial role in achieving this goal as they require an increase in the number of bank accounts. Therefore, opening bank accounts is a necessary step towards achieving digital financial inclusion. The digital payments market in Iraq has grown significantly, resulting in a remarkable increase in the number of bank accounts being opened daily. The Association of Private Banks reported this development a few days ago. This growth indicates that the Iraqi banking system is undergoing significant change and development, which is in line with the government’s current program for the new digital era in Iraq.